Do Certain Cars Make My Car Insurance More Expensive?

Free ConsultationWhen shopping for a new car, we often look for things such as style, comfort, and good gas mileage. However, an equally important factor often goes forgotten: the cost of insuring the new car you buy. NerdWallet looked into the best-selling cars of 2017 and analyzed car insurance premiums to see which ones are the most affordable to insure. We compiled this information for you to help you make an informed decision when purchasing your next car.

According to NerdWallet, the top five least expensive cars to insure are:

- Subaru Outback

- Ford Escape

- Chevrolet Equinox

- Toyota RAV4

- Honda CR-V

All of these cars have an average annual premium that falls between $1,566 and $1,753. It is speculated that these are the more affordable cars to insure because the people driving these types of cars are responsible, parental types, according to Joe Wiesenfelder, executive editor of Cars.com.

NerdWallet reports that the bottom five least expensive cars to insure are:

- Chevrolet Malibu

- Toyota Camry

- Nissan Altima

- Nissan Sentra

- Toyota Corolla

The average annual premium for all of these cars falls between $1,912 and $1,980. Although these cars are still affordable, they tend to cost a little more to insure than the cars mentioned above. This might be because these cars are often stolen the most based on the car’s desirability and demand for its parts, so they pose more of a risk.

Forbes wrote that the top five most stolen new cars are:

- Toyota Camry

- Nissan Altima

- Toyota Corolla

- Dodge Charger

- Ford Fusion

According to NerdWallet, car insurance companies base premiums off the risk you and your car may present. For example, even larger cars that appear safer, such as SUVs, can have higher insurance premiums because of the potential to cause more damage to the other car if you are ever involved in an accident.

It is also important to note that expensive sports cars will be more expensive to insure in general. This is because they are designed to be driven fast, which means they have more potential to cause accidents. These cars are also more expensive to replace or repair in the event of an accident.

Kelley Blue Book recommends saving money by considering a car in the mid-size category that has less horsepower. Overall, it is important to consider what cars will be more expensive to insure while shopping for a new car. In addition to personal preferences, size, lifestyle, and desirability are all factors to consider when deciding on a car, because these factors will ultimately affect your car insurance costs.

Here are more articles related to the same topic

The state of California requires that all drivers carry auto insurance. However, determining what type of insurance to purchase can be confusing. We’ve put together this guide so you can understand what auto insurance you must carry—and what you should carry.

What Are the Different Types of Auto Insurance in California?

The most common types of coverage your insurance will offer you include the following:

Liability Auto Insurance

In the event of a car accident, liability auto insurance covers the bodily injury and property damage you cause to another person. For someone’s liability coverage to go into effect, they must be found at fault, or liable, for the accident.

How Liability Works In California

Determining who is liable for causing a car accident is extremely important in the aftermath of a collision. The driver deemed at fault for the accident will be responsible for covering the costs of the other driver’s auto repairs and any medical treatment they may need. The payment for these costs comes from the at-fault driver’s liability auto insurance policy.

The auto insurance companies involved in the collision will usually determine who they think is liable after an internal investigation, and several factors—witness statements, police reports, or any statements made by the drivers—may influence their conclusion.

Sometimes, these companies will determine that both drivers were responsible for the collision. In these cases, California’s comparative fault laws allow a partially at-fault driver to recover damages from the other driver’s liability policy.

For example, if you were found 25% responsible for an accident, you can recover up to 75% of your damages from the other driver, assuming they have enough coverage. So if your car repairs cost $1000, you could recover $750 from the other driver’s insurance. You would be responsible for the remaining $250.

How Policy Limits Work

Like any insurance policy, a liability auto insurance policy has an upper limit of damages it will cover. This upper limit is called a “policy limit.”

For example, a bodily injury liability policy with a $50,000 limit will cover up to $50,000 of the other person’s medical treatment in an accident you cause.

Unfortunately, a victim’s damages may sometimes exceed the at-fault driver’s insurance policy limits. In these cases, the driver may be personally liable for the excess damages they cause.

California Liability Auto Insurance Minimum Requirements

Because car accidents happen so frequently in California, all drivers must carry minimum liability car insurance coverage to drive legally in the state.

The minimum coverage you must carry under California law is:

- $15,000 for the death or bodily injury of one person

- $30,000 for the death or bodily injury for all people hurt in an accident

- $5,000 for property damage

Keep in mind, this is the minimum required coverage. A victim’s medical and property damage costs will very quickly exceed these amounts in a serious collision. As stated earlier, the at-fault driver may be personally responsible for covering the difference if they don’t have enough coverage.

Though liability auto insurance is the most expensive type of insurance, carrying the maximum coverage you can afford is the best way to protect yourself if you’re involved in a costly and disastrous car accident.

Uninsured/Underinsured Motorist Coverage

Despite the law, the unfortunate reality is that many people in California drive without auto insurance. Even though they will be held personally liable if they cause a collision, many uninsured drivers do not have the means to pay for the other person’s damages.

Carrying uninsured motorist (UM) coverage may help you recover when you’re injured in an accident by someone who doesn’t have insurance. It pays for medical bills, funeral expenses, and other costs for people injured in a car accident caused by an uninsured driver.

Underinsured motorist (UIM) coverage provides similar benefits: if you’re injured by a person carrying the minimum liability insurance, your UIM coverage can help make up the difference between their insufficient policy limits and the actual cost of your injuries.

Notably, neither UM or UIM cover property damage caused by an uninsured or underinsured motorist. Instead, a separate coverage option—uninsured motorist property damage (UMPD) coverage—can cover these expenses. If you have collision coverage, however, you do not need UMPD.

While you are not required to carry uninsured/underinsured motorist coverage, your insurance company is required by law to offer it to you.

Uninsured/underinsured motorist coverage is always an excellent addition to your policy. It is relatively inexpensive and protects you from another person’s poor decisions and inadequate coverage.

Collision and Comprehensive Insurance

Together, collision and comprehensive car insurance cover damage to your car in various situations. When grouped with liability auto insurance, collision and comprehensive make up what is commonly known as “full coverage car insurance.”

Collision

Collision insurance covers damages incurred when your vehicle collides with something—even if the collision was your fault. This can include another vehicle, a guardrail, a tree, or a bicycle or pedestrian.

For example, let’s say your auto insurance determined you were at fault for an accident. In that case, your collision coverage would pay for damage to your vehicle, while your liability coverage would pay for damages to the other driver’s car.

Collision insurance also covers the cost of your car repairs if your car is damaged by an unidentified driver in a hit and run.

Comprehensive

On the other hand, comprehensive insurance covers damage to your vehicle caused by factors unrelated to driving. These may include, but are not limited to:

- Flood

- Falling objects, such as trees or rocks

- Theft

- Vandalism

- Fire

- Wind

- Hail

Insurance companies usually offer collision and comprehensive together. Premiums for these policies are based on the vehicle’s value, so they can be rather high for newer or more expensive cars. Coverage is also usually subject to a deductible.

Despite the price, collision and comprehensive is usually worth it for high-value vehicles. Full coverage is also required for leased or loaned vehicles in California.

Med Pay Coverage

Med Pay, short for medical payment coverage, is optional insurance that pays medical or funeral expenses in the event of a crash. Most Med Pay policies cover you, your passengers, and your immediate family members if they are hurt in a car, pedestrian, or public transportation accident.

Med Pay covers medical expenses regardless of fault, up to the policy limits. There are generally no deductibles, coinsurance policies, or restrictions on the medical providers you can visit. It may even cover medical treatment that your regular health insurance policy won’t cover.

Med Pay coverage is particularly useful for those without health insurance, or those with very high health insurance deductibles and copays.

What Happens If I Don’t Have Car Insurance in California?

Driving in California without the required minimum insurance coverage is against the law. California law requires drivers to show proof of insurance to law enforcement officers when asked. If you cannot show proof of insurance, you will need to pay hundreds of dollars in fines and penalties (which often cost more than the minimum required car insurance policy).

If you cause an accident without insurance, the DMV could suspend your driver’s license. Even if you’re hurt in an accident that wasn’t your fault, you will have less legal recourse if you don’t carry car insurance. In other words, you will not be able to recover pain and suffering damages from the at-fault driver if you don’t have insurance yourself.

So How Much Car Insurance Do I Need?

As lawyers are infamous for saying—it depends. If you park your car on the street in a high-crime area, it may be worth purchasing comprehensive coverage. Or if your deductible on your health insurance policy is very high, Med Pay might be worth it.

Ultimately, it’s best to purchase the maximum insurance coverage you can afford. After a terrible car accident, a hefty car insurance policy is the best way to protect yourself and others from unforeseen, life-changing damages.

PARRIS Fights for Victims of Auto Accidents

Any accident—whether a pedestrian accident, bus accident, motorcycle accident, or something else—is a devastating, preventable event that can change your life forever. Navigating the insurance world in the aftermath of an accident can be extremely confusing, especially when you’re facing a mountain of unexpected medical bills and expenses.

A trusted law firm can help. PARRIS car accident lawyers have been in the industry for nearly four decades. We have the expertise and resources to fight for you and your family, and we’ll make sure you see the justice you deserve.

Contact PARRIS today to schedule your free case review with our team.

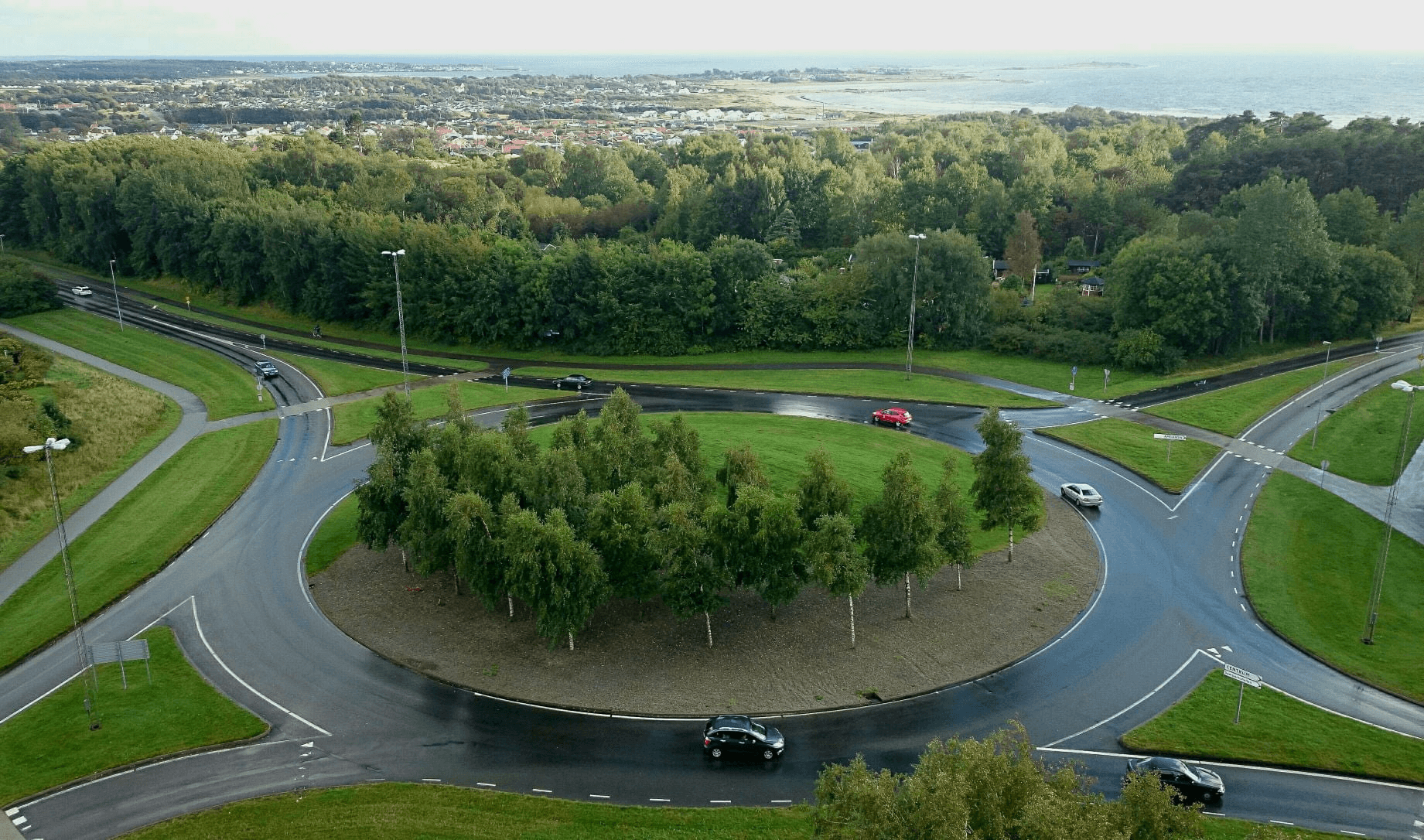

A roundabout, also called a traffic circle, is a type of vehicle intersection that seeks to increase traffic flow and reduce accidents. More common in Europe, roundabouts are beginning to catch on in the United States.

By creating a circular, continuous flow of traffic in one direction, cars don’t have to cross traffic or look in multiple directions before continuing safely. This intersection design has reduced car accident-related deaths and injuries where they are implemented.

Despite this, many drivers in the US don’t know how to navigate roundabouts. To the novice, a roundabout can be intimidating. Just ask the American tourists who crash their rental cars in European roundabouts each year. Unfamiliarity with the roundabout model can lead to an increase in accidents—the opposite effect of what was intended.

To help, our team of car accident lawyers at PARRIS Law Firm have created the ultimate guide to roundabouts: why they’re safer, how to navigate them, and how you can protect your rights if you’re struck by a negligent roundabout driver.

What is a Roundabout?

A roundabout is a circular intersection that links two or more streets. In countries like the US where cars drive on the right side of the road, roundabout traffic travels counterclockwise, usually around a center island or small obstruction.

There are usually no stoplights or stop signs for traffic in the roundabout or traffic entering the roundabout. There are some exceptions to this rule, however, most notably in Washington, DC, and in South Florida.

The key to driving safely in a roundabout is yielding to the traffic already in the circle, which in America means yielding to traffic on your left. We will cover more on this in the driving section below.

Are Roundabouts Safer Than Traditional Intersections?

The IIHS points out that roundabouts provide safer intersections by forcing drivers to slow down and eliminate right-angle and left-hand turns. This reduces the likelihood of head-on collisions, some of the most deadly accidents that can occur with much greater frequency in traditional intersections.

Roundabouts may also be safer for pedestrians. At a roundabout, pedestrians only cross one direction of traffic at a time. These distances are often shorter than those at traditional intersections, further reducing the dangers posed to pedestrians. Because cars are moving at slower speeds, this also reduces the likelihood of serious injury or death to pedestrians. At slower speeds, the cars can slow down faster to avoid impact with a pedestrian.

Let’s be clear, roundabouts don’t eliminate all car accidents. No solution is perfect. Sideswipe accidents can actually increase in multi-lane roundabouts, especially when the roundabout is new and drivers are still getting used to the traffic flow.

Other common accidents in roundabouts occur when drivers speed, misjudge the curvature of the traffic circle, and hit the center island or curb of the roundabout. These are usually single-vehicle crashes related to vehicle speed, driver experience, and weather or lighting conditions.

Despite these accidents, compared to traditional intersections, roundabouts are ultimately safer for drivers who understand how traffic flows in the circle. By slowing down and yielding to pedestrians and traffic within the circle, drivers are less likely to cause a deadly accident.

Do Roundabouts Save Gas?

In addition to their safety benefits, roundabouts also benefit drivers AND the environment by saving gas. Idling a car for two minutes at an intersection uses the same amount of gas as driving for a mile. By keeping traffic flowing continuously, roundabouts save gas and motor oil, thereby benefiting both consumers and the environment.

Why are Roundabouts Uncommon in America?

Despite their safety, environmental, and financial benefits, roundabouts haven’t really caught on in the US. America has the largest road network in the world, but only has about 10 to 15 percent of the world’s roundabouts.

Though California has more highway miles than every state except Texas, the Golden State has only three percent of all roundabouts in the US. They’re so rare in California that Caltrans has a helpful page discussing roundabouts and how to navigate them.

So why are roundabouts so uncommon in America? A large part of this issue stems from failures in their early adoption in the States. The first roundabout in the United States—Columbus Circle in New York City—opened in 1905. Roundabout right-of-way rules initially favored cars ENTERING the circle rather than cars already in the circle. When drivers in the roundabout stopped to let lines of cars turn in front of them, traffic quickly became congested, and accidents became common. As cities grew and their urban infrastructure developed, planners scrapped the idea of roundabouts entirely, instead favoring intersections governed by traffic lights.

Additionally, roundabouts tend to take up more space than a traditional intersection, making them difficult to add in urban areas. Though you can make roundabouts extremely compact, large ones tend to be safer as they provide more space for cars to navigate entry and exit points. Today, you might even have to buy and tear down buildings to convert a traditional intersection into a roundabout.

At this point, Americans are simply unfamiliar with roundabouts. Many drivers get nervous when they see one, likely because roundabouts aren’t common enough in the States for the average driver to practice and become accustomed to them. Though roundabouts are theoretically much safer than intersections, they may lead to more accidents if drivers are unfamiliar with right-of-way rules in a roundabout.

Roundabouts in Carmel, Indiana

In rural areas, however, roundabouts have begun to catch on. Take Carmel, Indiana, a suburb of Indianapolis, as a case study. Over the last two decades, they’ve converted over 120 traditional intersections into roundabouts.

Though it was initially a difficult adjustment for Carmel residents, the net outcome has been overwhelmingly positive. The city has reduced vehicle emissions, improved air quality for residents, and increased traffic and pedestrian safety. The city even designed their roundabouts with bikes and pedestrians in mind, working to ensure their safety along with more effective traffic flow.

How to Drive in a Roundabout

A roundabout works by keeping traffic moving. It accomplishes this by having cars entering the roundabout yield to cars already in the roundabout.

While roundabouts are still uncommon in California, you may see them with greater frequency as the years go by.

Here are several tips to help you safely navigate a roundabout when you come across one:

- Slow down as you approach the roundabout.

- Follow the traffic signs at the roundabout and the road markings, especially if the roundabout has multiple lanes

- You don’t have to stop before entering the roundabout, but you will need to reduce your speed.

- Before entering the roundabout, make sure you’ve looked left to ensure there’s no traffic coming.

- Always use your turn signal when exiting the roundabout to let drivers behind you know you’re slowing and exiting, and to let drivers waiting to enter the roundabout that you’re leaving it.

- If you miss your exit from the roundabout, go around instead of slamming on the brakes or making a hard turn.

- Keep an eye on the curvature of the traffic circle to ensure you don’t hit the curb and pop a tire.

Who Has the Right of Way in a Roundabout?

Generally, traffic in the roundabout has the right of way. Cars wanting to enter the roundabout must yield to cars already in the roundabout. Cars entering the roundabout must also yield to pedestrians and bikers crossing the street in front of them.

Roundabouts work by attempting to keep traffic flowing instead of a traditional intersection where only one set of vehicles moves at once. Drivers are forced to slow down, but not stop—making potential accidents less deadly.

Who Is at Fault in a Roundabout Crash?

Fault in car accidents depends on many factors. If you were driving in a roundabout and another vehicle hit you as they were entering the roundabout, they’re most likely going to be at fault for the crash. If another car rear-ended you as you were exiting the roundabout, the other driver is likely at fault.

Many common reasons for roundabout crashes include:

- Speeding

- Failure to yield

- Not being the correct lane

- Braking while in the roundabout

- Trying to exit the roundabout from the wrong lane

- Making a hard turn

- Tailgating

Can You Get Compensation from the Negligent Driver?

If you’ve been injured in a roundabout crash that was not your fault, you may be able to get compensation for:

- Pain and suffering

- Emotional distress

- Lost income

- Lost earning potential

- Loss of companionship

- Loss of life enjoyment

- Present and future medical expenses

- Rehabilitation costs

Depending on the severity of your injuries, you may face enormous financial pressure. Even in minor accidents, you could have to deal with costly medical procedures and treatment. Even a concussion, one of the most common car accident injuries, can result in millions of dollars of lifetime medical care.

That’s why you need to partner with an experienced and trusted car accident lawyer in California. Your lawyer may be able to help you get the compensation you need to get better. With the right legal team at your side, you may be able to avoid financial hardship by collecting compensation from the driver who caused your roundabout accident and injuries.

To find out your legal options, contact PARRIS Law Firm today to speak with an experienced California car accident lawyer. You have rights and we can help you protect them.

When someone’s negligence has hurt you or someone you love, filing a lawsuit against the at-fault party might be your best option. However, California law limits the period during which you can file a lawsuit.

What is a Statute of Limitations?

In legal terms, a statute of limitations is the law that limits how long you have to file a lawsuit. The length of time you have to file depends on the type of case you have.

Statutes of limitations were created in part to encourage the prompt investigation of crimes and wrongdoing. Evidence can be destroyed and witnesses’ memories can fade over time. They also prevent people from being punished for actions they took a long time ago.

What is the statute of limitations in California for filing a personal injury lawsuit?

According to the California Civil Code, personal injury lawsuits must be filed within two years of the date of the injury. Personal injury cases include those that stem from a wrongdoer’s negligence, including (but not limited to) motor vehicle accidents, dog bites, slip and fall accidents, and wrongful deaths.

Other personal injuries that are intentional, such as assault, battery, or intentional infliction of emotional distress, also carry a 2-year statute of limitations.

What is the statute of limitations for a medical malpractice claim in California?

Though medical malpractice cases are a type of personal injury case, California residents must file suit against their medical provider within one year of discovering the injury, or within three years after the date the injury was inflicted. Legislation makes it clear that the one-year timeframe begins on the day the plaintiff reasonably should have discovered the injury.

Additionally, California law specifies that medical malpractice lawsuits can only be brought after a 90-day notice is given to the healthcare provider.

Is the statute of limitations different if you are suing the government?

Yes—if you have been harmed by a government agency, you must file a government claim form against the entity within six months of the date of injury. A “government agency” can include any publicly-funded organization, such as a public school, a city’s sanitation department, or a state government.

Once your lawyer has filed a government claim form, the entity has 45 days to respond. If they deny the claim, you have six months from the date the denial was received to file suit. If they do not respond, you have two years from the date of the initial injury to file suit.

What about the statute of limitations for employment law cases?

The appropriate legal deadline for employment-related lawsuits depends on the type of claim.

Claims related to proper pay stubs must be brought within one year of an employer’s failure to provide proper payment records.

However, most claims related to unpaid wages may be brought within three years of the initial failure to pay. These case types include those related to missed meal and rest breaks, minimum wage, overtime pay, and more.

Other employment law cases, such as wrongful termination, carry the two-year statute of limitations shared by most personal injury lawsuits in California. A recent California law extended the statute of limitations for workplace harassment to three years from the date of injury.

What happens if you miss the deadline to file a lawsuit?

If the statute of limitations has passed on your case, you will no longer be able to bring your case and obtain legal recovery.

Are there any exceptions to the statute of limitations?

There are some exceptions under which the statute of limitations is tolled. Tolling means that the statute of limitations is suspended. The “clock is paused,” so to speak, and then begins again when the reason for tolling is over.

Tolling may happen when the plaintiff is under 18, suffering from a disability, in prison, and/or serving in the military, among many other situations.

When the reason for tolling ends, the statute of limitations begins to run again.

Call PARRIS For Help Meeting Legal Deadlines

Understanding the statute of limitations can be complicated, since there are many different deadlines and exceptions under California law.

It’s crucial to contact PARRIS accident attorneys as soon as you decide that you want to pursue a legal claim to ensure that any legal deadlines are met. Start your free case consultation today by calling PARRIS at (661) 485-2072. You pay no fees until we win you compensation.

On November 9, 2018, Judge Yvette Palazuelos ruled that the City of Santa Monica’s at-large voting system violated the California Voting Rights Act and intentionally discriminated against minorities, violating the Equal Protection Clause of the California Constitution.

At-large elections, like Santa Monica’s current election system, allow every person in the city to vote for all City Council members. This system seems fair at first glance, but it prevents minority voters geographically concentrated into one area from electing members to the City Council to represent their interests. Plaintiff Maria Loya writes, “Since the adoption of an at-large election system in Santa Monica, the majority of the people elected to the City Council have lived north of Wilshire [a predominantly white area]. This is no coincidence; this outcome was by design, to make it difficult for people of color to attain fair representation.”

R. Rex Parris and Ellery Gordon of PARRIS, along with attorneys Kevin Shenkman and Milton Grimes, made it their mission to prove that Santa Monica’s at-large elections were intentionally designed to suppress the minority vote.

Throughout the trial, the PARRIS team demonstrated the negative effects the at-large election system has had on the predominantly Latino residents of the Pico Neighborhood for over 60 years. Judge Palazuelos’ ruling provides these residents with the opportunity to have a voice on Santa Monica’s City Council.

Before Judge Palazuelos’ ruling, the City burdened the Pico Neighborhood with its most undesirable land uses. Not only is there a freeway running through the area, but it is also used as a dumping ground for environmental hazards such as the vehicle maintenance yard and trash sorting facility. Worst of all, the city has taken no action to remediate the methane being emitted from Gandara Park—a place where kids regularly play in sporting events.

The plaintiffs fought for the Pico Neighborhood to have equal representation on the Santa Monica City Council to ensure accountability for the city’s actions. This ruling will allow the residents of the Pico Neighborhood to finally be heard.

In the wake of COVID-19 and the political, social, and economic upheaval that followed, the California state legislature has responded by passing hundreds of new laws. From healthcare to marriage to law enforcement, these new rules affect the daily lives of everyone in the state. Here is a quick guide to some of California’s most significant new laws going into effect this year.

Housing

Single Family Lots: SB 9, SB 10

Perhaps two of California’s most notable new laws from 2021 address the state’s housing crisis. SB 9, the “duplex bill,” will allow homeowners to build duplexes, triplexes, or fourplexes on their single-family lots. SB 10 streamlines the rezoning process for those who wish to do so.

To comply, the following conditions must be met:

- The property cannot have been used as a rental property for the past three years

- The property cannot already have a second dwelling unit

- The new lot may not be less than 40% of the property and must be at least 1200 square feet

- Modifications to the existing home may not require demolition of more than 25% of an exterior wall

- Neither the new duplex nor the lot split can cause adverse impact on the physical environment

Both laws go into effect on January 1, 2022.

Multifamily Developments

For any residential structure with five or more dwelling units which include both affordable housing units and market rate housing units, AB 491 requires the affordable housing units must have the same access to building entrances, common areas, and amenities as the market rate housing units. This law may be applied retroactively.

Digital Privacy

California Privacy Rights Act

In 2020, California citizens voted yes on Prop 24, better known as the California Privacy Rights Act (CPRA). The law expands on the California Consumer Privacy Act (CCPA) and establishes new rights for the state’s consumers:

- Right to access the personal information a business has collected about you

- Right to limit or opt out of the sharing/selling of personal information

- Right to sue businesses for negligently exposing usernames, passwords, or personal information in a data breach

The law also further regulates “high risk data processors” and enables special protections for minors browsing the internet.

The full provisions of the law for consumers don’t go into effect until 2023, but businesses are expected to comply on January 1, 2022.

Personal Health Care Information

AB 825 expands the definition of personal information as it relates to health care data. Now including genetic data, the law requires businesses to put in place reasonable safeguards and alert consumers of any data breach of their personal information.

Genetic Information Privacy Act

SB 41 requires genetic testing companies to provide consumers with a notice about their data collection practices. The new law also requires companies to get a consumer’s express written consent to collect, use, or disclose an individual’s genetic data. It also requires companies to destroy a consumer’s biological data within 30 days of receiving revocation of consent.

Multifamily Developments

For any residential structure with five or more dwelling units which include both affordable housing units and market rate housing units, AB 491 requires the affordable housing units must have the same access to building entrances, common areas, and amenities as the market rate housing units. This law may be applied retroactively.

Law Enforcement

Peace Officer Decertification

SB 2 gives a new division within the Peace Officer Standards and Training commission the power to investigate and/or decertify police officers accused of misconduct. The bill also prohibits officers stripped of their licenses from applying for jobs in another California police jurisdiction.

Police Age & Education

AB 89 raises the age at which you can become a police officer from 18 to 21. The law also requires that California community colleges develop a modern policing degree program for prospective officers in the state, to be implemented in 2025.

Hate Crime Education

AB 57 calls for increased training for law enforcement regarding hate crimes. Police officers must be educated on hate crimes (including religion-bias hate crimes) by subject matter experts.

Healthcare and COVID-19

COVID-19 Exposure Notification

AB 654 requires employers to provide notice to the local public health agency of COVID-19 positive tests within 48 hours or one business day, whichever is later. It also requires employers to notify employees, customers, and anyone else onsite who may have been exposed.

Hepatitis B and C Screening

Adult patients receiving primary care services in California must be offered a screening test for hepatitis B and hepatitis C to the extent these services are covered under a patient’s health insurance. (AB 789)

Affordable Medical Care

Another new law makes medical care more affordable for those without insurance or those under 400% of the federal poverty level. (AB 1020)

Healthcare Bias Training

Beginning January 1, 2023, nurses will be required to take implicit bias training. For every two years on the job, nurses must take a one hour course. (AB 1407)

Education

Mental Health Education

Each public school district in California is now required to offer mental health coursework for middle or high school students. The State Department of Education must develop a plan to implement mental health coursework in schools by January 1, 2024. (SB 224)

Free College Tuition for COVID-19 Survivors

AB 1113 allows the children or spouse of a nurse or physician who died of COVID-19 during California’s state of emergency to receive free tuition from any public postsecondary school in California (the UC system, Cal State schools, or community colleges).

CalFresh in College

California public colleges are now required by AB 543 to educate incoming students about the eligibility requirements for CalFresh, California’s Supplemental Nutrition Assistance Program (SNAP).

Food and Beverage

Takeout Alcoholic Beverages

SB 389 allows customers to order alcoholic drinks to go with their takeout food through 2026.

Restaurant Delivery Apps

Under AB 286, food delivery apps, such as Grubhub or Postmates, are not allowed to retain tips. If the food is for pickup, then the tip goes to the restaurant. If it is delivered, then the delivery driver keeps the tip.

Miscellaneous

Enforcement Liens on Real Property

SB 572 allows the Labor Commissioner to create a lien on an individual’s real property to secure amounts due under a citation, finding, or judgment.

Environmental Marketing Claims

SB 343 sets out to restrict environmental marketing claims made to California consumers. When a company claims a product is recyclable, biodegradable, or compostable, it must now be able to back those claims up with evidence. Previously, any company could put those logos on their products and there was no requirement that the products actually comply. This new law expands to all consumer products sold in California and enacts penalties of up to $2500 per violation.

Remote Marriages

In light of COVID-19, county clerks are now able to issue marriage licenses and solemnize marriage ceremonies using remote technology. Notably, the couple wishing to get married must be in the same physical location within California. (AB 583)

PARRIS Is Here to Help

We hope that this roundup of new laws in California has been helpful. With the sheer amount of regulations in California, understanding the implications of new additions can be quite overwhelming.

Remember—if at any point your rights as a California resident have been violated, call PARRIS Law Firm. We are here to fight for you.

As of June 15th, 2021, California has officially reopened after 15 months of unprecedented pandemic restrictions. The Golden State is down to 1.8 new COVID-19 cases per 100,000 residents each day – low enough, according to our legislators, to reopen the state.

This is a significant milestone for both PARRIS and the state of California. A new season is beginning, both literally and metaphorically. In light of these recent changes, we wanted to pause for a moment and acknowledge the PARRIS team’s many achievements since the pandemic began. What have PARRIS lawyers and staff been able to accomplish in these 15 months at home?

Exciting Victories

Despite working from home, PARRIS attorneys achieved more than 350 settlements on behalf of clients in 2020. Here are some highlights:

- A wrongfully terminated client received a $1.05 million verdict with the help of the PARRIS employment team.

- A rollover car accident victim received a $23 million settlement for their injuries.

- An apartment complex assault victim recovered $1.3 million after suffering severe injuries.

- A trucking accident victim secured a $17.5 million victory in late 2020. Given the complexity of truck accident cases, this is a significant accomplishment for both the plaintiff and the firm.

New Cases

Throughout the turbulent pandemic season, the team at PARRIS ensured that those facing hardship got the compensation they needed to thrive.

- In May 2020, PARRIS attorneys began litigating against overreaching policing practices enforced on a Black Lives Matter protestor, Randy Stewart, injured by the LAPD during a peaceful protest. The rubber bullets fired by the LAPD left Randy with a traumatic brain injury (TBI), a brain hemorrhage, blurred vision, difficulty speaking, PTSD, tinnitus, and more.

- In September 2020, PARRIS moved to protect a popular local brewhouse, Transplants Brewing, from hardship by forcing LA County to allow the brewery to open. At the time, LA County permitted most restaurants to reopen with limited-capacity outdoor seating, but prevented those that lacked an “on-site” kitchen like Transplants. With the help of PARRIS, Transplants sued the County, citing violations of the business’s rights to due process and equal protection under the 14th Amendment. On filing the lawsuit, the LA County Board of Supervisors voted to remove the on-site kitchen requirement, allowing breweries like Transplants all over the county to reopen.

- In February 2021, PARRIS attorneys filed a class-action lawsuit against the Los Angeles Department of Water & Power (LADWP) for their role in covering up a massive gas leak at the Sun Valley Generating Station for at least three years. Sun Valley and Pacoima residents were exposed to toxic gas fumes that caused recurring headaches, bloody noses, shortness of breath, eye and skin irritation, severe anxiety, and nausea. According to LA Times reporter Lila Seidman, the community around the 70-year-old Valley Generating Station is home to largely Latinx and Black residents that are regularly exposed to some of LA’s worst air quality. PARRIS’s lawsuit seeks to recover monetary damages to pay for medical care and cleaning for affected residents living within 3 miles of the plant.

Key Recognitions

2020 wasn’t all bad news. Our firm hit some major milestones in the last 15 months:

- PARRIS Law Firm turned 35! Since Rex and Carrol Parris founded the firm in 1985, PARRIS attorneys have won over $1.9 billion for clients. Even now, we remain committed to the same vision our founders had all those years ago: building a truly great law firm.

- The Daily Journal—one of the West’s top legal news sources—recognized R. Rex Parris as one of California’s Top Plaintiff Lawyers in June 2021. The Daily Journal recognizes exceptional legal talent in their annual lists, which are selected after careful review of hundreds of attorney nominations.

- U.S. News named R. Rex Parris and Robert A. Parris to their prestigious list of 2021 Best Lawyers; and also named Khail A. Parris to their 2021 Best Lawyers: Ones to Watch list. That’s three PARRIS attorneys with national recognition for their legal feats in 2020.

PARRIS Cares

When the PARRIS team isn’t fighting for fairness in the courtroom, we take care of our own: our community.

- In the wake of George Floyd’s death in the summer of 2020, PARRIS donated $50,000 to the Equal Justice Initiative, a nonprofit committed to fighting racial and social injustice in the United States. EJI works within communities, the criminal justice system, and the education system to expose injustice and advocate for those victimized by it.

- Founding partner R. Rex Parris and firm administrator Carrol Parris have donated $50,000 to CarthroniX, a biotech company focused on developing therapies for aging-related diseases. The donation will assist Dr. Denis Evseenko’s research in slowing the progression of arthritis.

The pandemic has been difficult on all of us, and we are beyond excited to begin the process of safely returning to life in person. Despite the hardship of being apart, our firm has grown stronger knowing that we’re all in this together. Going forward, we hope to employ the same resiliency we’ve learned in this pandemic as we continue to fight for our community in the courtroom.